We are Your Best Choice for Education Loans

Empowering Students Through Education Loans

Check Eligibility

Discuss your educational needs with our experts to understand the best loan options for you.

Application Process

Complete our user-friendly online application form and submit required documents.

Approval

Our team will review your application promptly, ensuring a quick approval process.

Disbursement

Once approved, funds are disbursed directly to your educational institution, empowering your academic pursuits.

Our Social Media Presence

Our Trusted Lending Partners

Get an Education Loan for Your Preferred Country

EMI Calculator

0 INR

0 INR

0 INR

We Have The Best Options For Your Financing !

At North24, we’re here to help students afford their education. We offer loans that are easy to understand and apply for. Our goal is to make sure students get the money they need quickly, so they can focus on their studies and achieve their dreams.

What We Do

Top 5 Strategies for Securing Education Loans Without a Co-signer

We Are Most Experience & Offer Best Services.

Our extensive experience and commitment to excellence set us apart. We pride ourselves on delivering the highest quality services, tailored to meet the unique needs of each client, ensuring unparalleled satisfaction and success.

Get A Free Quotes How We Operate For You !

Request a free quote to learn how our tailored education loan solutions can work for you. Get started today!

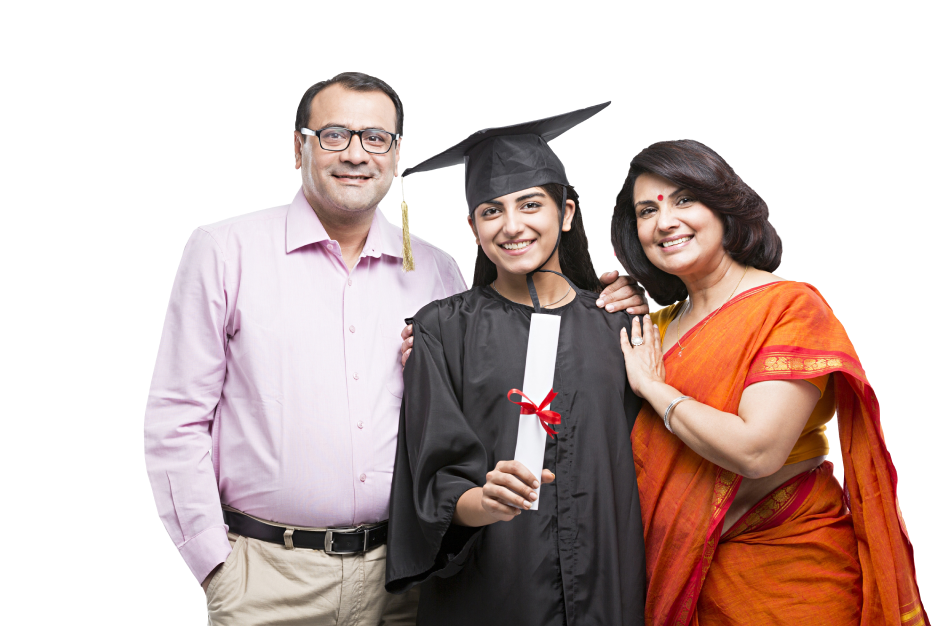

Our Happy Clients

Office Branches

Our Active Members

Award Achievement

What Our Clients Says

North24 made my education dreams a reality. Their efficient process and personalized support ensured I could focus on my studies without worrying about finances. Highly recommended!

Vijay

I’m grateful for North24’s support throughout my academic journey. Their transparent approach and quick approvals made securing an education loan hassle-free. Thank you for helping me achieve my goals!

Kalyan

FAQs

Can I get an education loan without collateral or a co-signer if I'm not studying at a top-tier university?

Yes, it’s possible to secure an education loan without collateral or a co-signer even if you’re not attending a top-tier university. While being admitted to a renowned institution can improve your loan terms, there are other factors like your academic record, future earning potential, and government schemes that can aid in securing a loan.

How do I improve my chances of getting an education loan without a co-signer?

Are there any risks associated with taking an education loan from international lenders?

Understanding Education Loans: Non-Collateral vs. Collateral

In the pursuit of higher education, securing funding is often a critical step for many students. Education loans provide the financial support needed to cover tuition fees, living expenses, and other related costs. Two common types of education loans are non-collateral (unsecured) loans and collateral (secured) loans. Understanding the differences between these two options can help students make informed financial decisions.

Non-Collateral Education Loans

What Are They?

Non-collateral education loans do not require borrowers to provide any asset as security. Instead, the loan is granted based on the borrower’s creditworthiness, income potential, and the reputation of the educational institution they are attending.

Advantages:

No Asset Requirement: Borrowers do not risk losing any valuable assets if they default on the loan.

Faster Processing: These loans often have a quicker approval process compared to collateral loans, enabling students to access funds more promptly.

Greater Accessibility: Non-collateral loans are particularly beneficial for students without significant assets or property to offer as collateral.

Disadvantages:

Higher Interest Rates: Due to the increased risk for lenders, non-collateral loans usually come with higher interest rates.

Strict Eligibility Criteria: Borrowers may need a good credit score or a co-signer with a strong financial background.

Limited Loan Amounts: The total loan amount may be lower compared to collateral loans, depending on the lender’s policies.

Collateral Education Loans

What Are They?

Collateral education loans require borrowers to pledge an asset, such as property or savings accounts, as security for the loan. In the event of default, the lender can seize the collateral to recover the loan amount.

Advantages:

Lower Interest Rates: Secured by an asset, these loans typically come with lower interest rates, making repayment more manageable.

Higher Loan Amounts: Borrowers can often secure larger amounts of funding due to the reduced risk for lenders.

Flexible Repayment Options: Lenders may offer more flexible repayment terms for secured loans.

Disadvantages:

Risk of Asset Loss: Defaulting on the loan can result in losing the pledged collateral, which can be financially devastating.

Longer Processing Time: The approval process for collateral loans may take longer due to additional paperwork and assessments of the pledged assets.

Requires Ownership of Assets: Borrowers need to own valuable assets to secure the loan, which may not be feasible for all students.

Conclusion

Choosing between a non-collateral and a collateral education loan ultimately depends on individual circumstances, including financial stability, asset ownership, and risk tolerance. Students who have significant assets may find a collateral loan advantageous due to lower interest rates and higher funding amounts. Conversely, those who prefer not to risk their assets and need quicker access to funds may benefit from a non-collateral option.